Link copied

Top analyst unveils stocks to target for rest of 2025

investing ideas :: 2025-02-04 :: source - thestreet

By Michael Sheldon

Stocks have a tendency to generate positive full year returns after stocks rally between election day and the inauguration.

Michael M. Santiago/Getty Images

The technology stock selloff after DeepSeek's surprising launch is raising many questions about what could happen to stocks next.

It's certainly been good times for investors. The S&P 500 has delivered back-to-back 20% plus annual returns, and despite a swoon in the first week of January and the DeepSeek sell-off this week, the benchmark is still on pace to finish January with gains.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Of course, whether that trend continues throughout 2025 is anyone's guess, but if history is our guide, the odds appear good.Typically, more returns follow when stocks rally between election day and the inauguration. If that trend holds, then research from CFRA suggests it makes sense to focus on some stocks more than others.

What past performance may tell us about the future

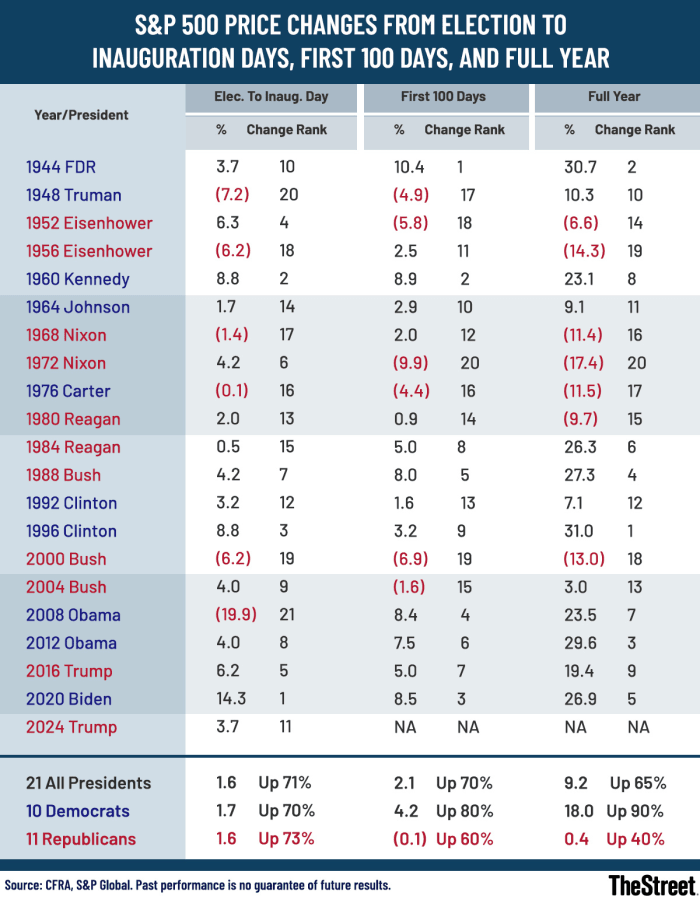

This time around, from election day through inauguration day, the S&P 500 gained almost 4% (actually 3.7%) versus an average of 1.6% in all years dating back to 1944.

As a result, the market’s performance from election day to inauguration day ranks 11th out of 21 periods over the past several decades.

The highest return during this period came from the Biden administration (+14.3%), while the worst market performance came from President Obama (-19.9%) due to the financial crisis that took place from 2007 to 2009.

The good news is that based on past periods, when returns were positive from election day through inauguration day, that led to positive returns over the next 100 days and the rest of the full calendar year almost 80% of the time.

When stocks have rallied between election day and inauguration day in the past, returns for the full year have been solid.

TheStreet/CFRA

In addition, based on data from 1993, the top four sectors in the S&P 500 that outperformed the market during this period went on to outperform the market over the remainder of the year, about 75% of the time.

They delivered calendar-year gains of 17.0% on average, compared to the S&P 500’s average return of 15.9%, according to CFRA.

The top 10 S&P 500 industries during the period did even better, increasing by 26.8% for the full year.

Of course, what worked in the past is not guaranteed to work again in the future, but the data is intriguing.

Which S&P 500 sectors outperformed and underperformed after the election

This time around, the four sectors that generated the best performance between election and inauguration day were

Consumer discretionary: Up 13.5%

Communication services: Up 8.7%

Financials: Up 7.3%

Energy: Up 4.3%

Consumer staples, health care, materials, and real estate all posted declines.

The four industries that generated the best performance between election and inauguration day were

Auto manufacturers: Up 59.5%

Home furnishing retail: Up 46.9%

Security & alarm services: Up 40.4%

Drug retail: Up 30.1%

Another part of the puzzle is the outlook for corporate profits. Based on recent data from JP Morgan (source: IBES as of January 20th, 2025), all 11 S&P 500 sectors are currently forecast to post positive EPS growth in 2025 (versus 9 out of 11 sectors in 2024).

Six sectors are currently forecast to post double-digit year-over-year EPS growth in 2025 (versus 5 in 2024).

The sectors currently forecast to generate the highest 2025 year-over-year EPS growth include:

Technology: Up 22.3%

Healthcare: Up 20.2%

On the other hand, energy, consumer staples, and real estate are the three sectors forecast to post the weakest year-over-year EPS growth this year.

Here's what could happen to these sectors now

Many factors can influence predictions of which stocks will likely outperform the market over a specific period. One list might include changes in earnings, revenues, margins, free cash flow, profitability, management, the introduction of new products, the macro-economy, balance sheets, currencies, etc.

More 2025 stock market forecasts:

For our purposes, let's look at:

1) The top three sectors that outperformed the market from election day to inauguration day.

2) The greatest upside to the average analyst target price estimate over the next 12 months for stocks within those sectors, according to YCharts.

The results:

Communications Sector: Electronic Arts (EA) (30.1%), Comcast (CMCSA) (26.8%) and Warner Brothers (WBD) (23.9%).

Consumer Discretionary Sector: MGM Resorts (MGM) (48.1%), Caesars Entertainment (CZR) (46.3%) and Las Vegas Sands (LVS) (36.6%)

Financials Sector: Arch Capital Group (ACGL) (26.7%), Global Payments (GPN) (21.2%) and Allstate (ALL) (21.3%).

This article was first published on Thestreet